Why Accept Bitcoin as Payment at Your Business

Why should you accept bitcoin as payment at your business? It’s a good question that too many bitcoiners shrug off as obvious. But it’s good to re-examine these fundamental questions from time to time. So… why?

Economic Freedom and the Silent Tax of Inflation

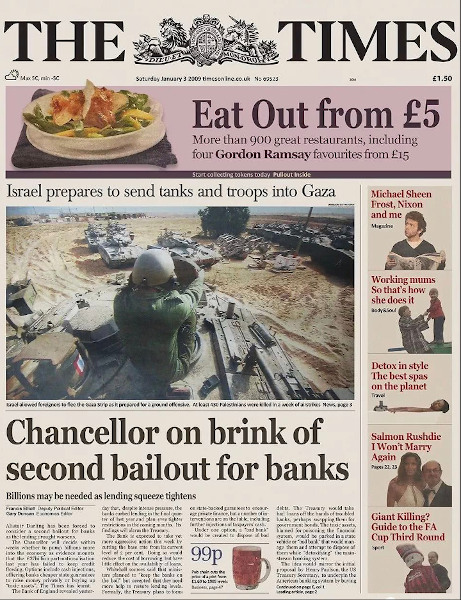

Chancellor on Brink of Second Bailout for Banks

It was not a coincidence that the above message was encoded by Satoshi Nakamoto in the “genesis block” – the very first block in the bitcoin blockchain. This was a clear statement about why bitcoin was created.

Back at the beginning of the 2008/2009 financial crisis, there was a broad sense of unfairness that the biggest financial institutions were bailed out while regular citizens were left to pick-up the bill.

Unprecedented government deficits and debts were accumulated. New money was “printed” and injected into the system at the top. Over the next decade this resulted in massive inflation in the price of assets from stocks to real-estate. Those who couldn’t afford to acquire such assets were left with savings that has lost more and more of its purchasing power year after year.

Bitcoin offers a way to opt-out of this system. It is a new method to save your money in an asset that cannot be manipulated or controlled by governments or international financial institutions.

#StackSats

The hash tag has become popular in recent years. It expresses a preference towards the slow and steady accumulation of bitcoin by buying small amounts regularly over time. Accepting bitcoin as payment at your business is a great way to “Stack Sats” without buying bitcoin directly. Instead you sell products or services in exchange for bitcoin.

For example, if you operate a food truck: The ingredients, fuel, electricity, and other supplies that you need for your day-to-day operations can be paid for using your local fiat currency. Then when you sell the food that you produce you can receive bitcoin. The small percentage of your customers that pay with bitcoin will be a nice way to begin to #StackSats.

Merchant Protection

The oft dreaded charge-back is a threat that hangs over the head of every online retailer. Sometimes months later, money can be taken from a merchant’s account because of a fraud claim by a customer. The customer’s credit card details might have been stolen and used to make fraudulent purchases at several online retailers, product shipped, and then weeks or months later the credit card holder notices the errant charges on their statement.

The payment processors and credit card networks call this “consumer protection”. Most credit cards have built-in protections for the consumer against fraudulent payments made with their credit card both online or at in-person businesses. They have made it easy for the customer to flag fraudulent payments. Typically this means that the customer will get their money back and the merchant suffers lost inventory and revenue.

Online retail giants like Amazon absorb the cost of fraud in favor of protecting their customers. But small businesses don’t have the scale or volume to do that. So what can they do to protect themselves?

With payments made via bitcoin the situation is flipped around. Once an on-chain transaction has been confirmed or once a Lightning payment has settled, it is no longer possible for the payment to be reversed. The customer can reach out directly to the merchant to handle disputes and the merchant can decide what action to take. But in general, it’s up to the customer to ensure the security of their bitcoin private keys or accounts.

Attract New Customers: Bitcoiners

Though not true of all people in the bitcoin space, some bitcoiners are more likely to be a customer of your business simply because you accept bitcoin as payment – they want to support businesses who are using bitcoin as a currency.

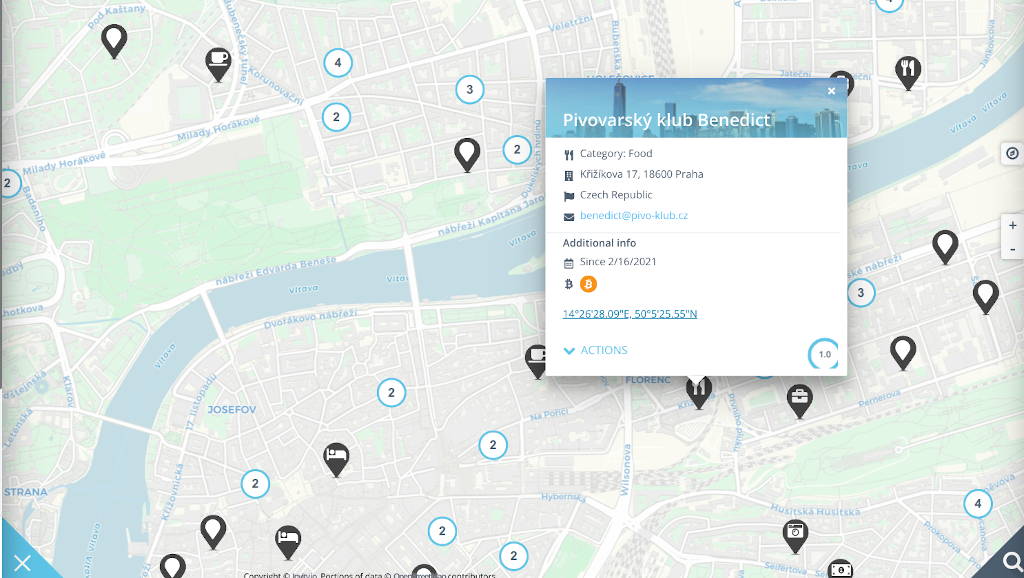

There are a few websites dedicated to sharing the locations of in-person businesses that accept bitcoin as payment. Adding your own listing is easy. So once you’re ready, go ahead and add your business’ location to the map and hopefully your fellow bitcoiners will heed the call.

How to Accept Bitcoin Payments

There are several ways that you can begin accepting bitcoin payments.

First it’s important to understand the difference between on-chain transactions and Lightning payments. Both are bitcoin. But on-chain payments are slower, more expensive, and if you aren’t waiting for at least one confirmation then you risk being double-spent. Lightning payments are faster, cheaper, and provide better privacy than on-chain payments. Once a Lightning payment has “settled” – it’s done. It is not possible to double-spend a Lightning payment.

Online Payments

There are many options available today for accepting bitcoin payments online. At Bleskomat, we use our own self-hosted instance of BTCPay Server which integrates easily with our e-shop. We accept both on-chain and Lightning payments.

Self-hosting does require a bit of technical skill, so if you need something easier, there are some hosting providers available which make it easier to setup and manage your own BTCPay Server instance. One such provider is Voltage.

There are also many custodial bitcoin service providers that could help you to begin to accept online bitcoin payments. Which one is right for your business depends on your specific needs and skill set.

In-Person Payments

To accept in-person bitcoin payments, we recommend to only accept Lightning payments – which are faster and cheaper than on-chain payments.

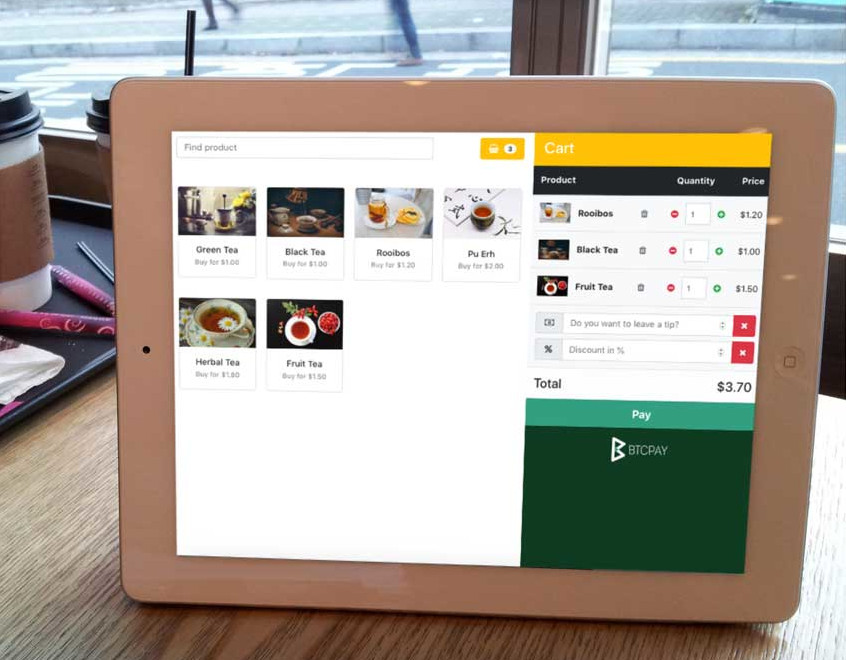

If you already have your own BTCPay Server, you can use its Point-of-Sale app to start accepting in-person payments. Its features include product management, shopping cart, tips, product inventory, custom payment options and more.

You can use a dedicated mobile device (phone or tablet) with a browser window opened to your BTCPay Server’s POS App.

Alternatively, you can use a Bitcoin Lightning mobile wallet app installed on a dedicated mobile device. We recommend either Phoenix or Breez. They are both self-custody, so you are responsible to write down your 12-word seed phrase and keep it safe. And it is possible to receive both on-chain and Lightning payments with either of these wallet apps. The fees that they charge are reasonable, but be sure to read the details so that you are not surprised.

One additional feature of Breez which might make it more interesting is a built-in Point-of-Sale “app” (interface).

Another mobile wallet app worth mentioning is Wallet of Satoshi. It is the easiest way to begin accepting bitcoin Lightning payments on a mobile device. But it is custodial, so we recommend not to leave much money in the app. You should regularly withdraw the funds to your own self-custody bitcoin or Lightning wallet.

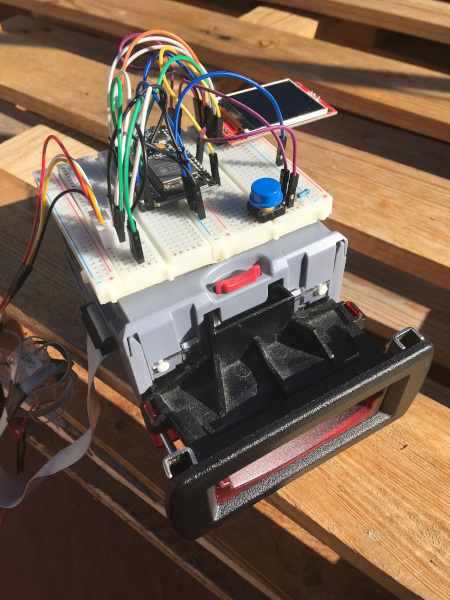

And finally, we would like to mention the Bleskomat POS which is an offline point-of-sale terminal device to accept in-person bitcoin Lightning payments. We are still working to finalize the product for sale. So stay tuned for future updates.